A digital SACCO for your business

Struggling with slow approvals and complex processes? At SFA, we believe banking should simplify, not stifle, your growth. Our intuitive digital platform offers faster loan approvals, seamless transactions, and dedicated support, giving you more control, time, and peace of mind to focus on what matters most - building your business.

No complicated legal forms required

Trusted by 6,000+ small businesses and startups.

Small Businesses Need Banking Built by Owners

We all know how broken the banking landscape is for small business owners: collaterals, months-long application processes, hidden fees, complicated legal forms filling, in-person branch visits, corruption, and unnavigable UI. So we started SFA to give members the fast, beautiful final experience we knew they were missing.

We’re reimagining the small businesses banking experience by combining the stability of a bank with intuitive technology that gives owners more control, more time, and more peace of mind.

Sign up today and conquer KYC like a financial ninja. Start by saving TZS 50,000 monthly, purchase your 10 shares @ TZS 80,000 within 6 months, and start by saving TZS 50,000 monthly. It's not just numbers; it's the rhythm of your financial heartbeat.

We breathe life into your monthly savings by smartly investing in our members' profitable ventures. Our capital fund model ensures secure, liquid investments, and when it comes to loans, we keep it real with single-digit interest rates for our members.

Banks aren’t designed for the pace of small businesses and creativity of start-ups

It’s no secret that banking is broken for most Tanzanians. Wealthy customers get access to the best loans, investments, & services, while regular, hard-working customers are ignored.

Last year the big three banks recorded record profits of nearly Sh 1.5 trillion, but 98% of people we surveyed said that their banks do nothing to get them ahead financially.

You give your bank your hard-earned money, but what does your bank do to help YOU get ahead?

Did you know that at least 6 of 10, or at least 77%, of small business loans, are unfunded or underfunded?

That’s at least 2.3 million loan applications unfulfilled, which means at least 2.3 millions businesses do not get the support they need to grow and serve their communities.

And when you consider the average loan size of small businesses – $5,000 – that means Tanzania has a working capital cap of at least $3.7 billion.

2.3M

Underfunded loans

$3.7B

GAP

Between small businesses and financial institutions such as Banks and CDFIs

The Missing Piece for Thriving Businesses

$5,000

That's the number that separates countless Tanzanian entrepreneurs from achieving their dreams. This seemingly small sum represents the working capital needed for essential business functions like rent and payroll, the fuel that keeps the engine running.

However, the path to acquiring this crucial funding is often paved with frustration. Existing community institutions like VICOBA, SACCOs, and CDFIs, while present within communities and familiar with the struggles of small businesses, often lack the technological infrastructure, resources, and risk tolerance to adequately meet the overwhelming demand.

Lending to small businesses is often perceived as a time-consuming, inefficient, and risky endeavor, leading some to simply turn away.

This raises a critical question: who will advocate for the needs of Tanzania's small businesses?

Fueling African Dreams

As entrepreneurs, we're born to build, create, and disrupt - not sit around waiting on "maybe" from bankers who don't understand a thing about what truly fuels progress.

We both know that real change never comes from asking permission. It happens when visionaries say "enough is enough" and blaze their own trail, no matter what obstacles stand in their way.

Well, I've got great news - your days of begging the so-called "powers that be" for scraps are officially over because I'm about to let you in on a disruptive new opportunity that's about to turn the tables on how business is done around here.

You see, while banks aren't designed for our pace or creativity, there IS an alternative model that WAS created with entrepreneurs like us at the top of our minds. A solution that flips the script and puts control directly in OUR hands...

Together we can do things that we can’t do by ourselves. Together we’re wealthy and powerful and we can make the same money moves as the wealthiest people.

your partner in unlocking business growth.

When We Lift Each Other Up, No One Stays Down

SFA SACCO is a revolutionary business cooperative on a mission to transform how small businesses are funded and supported across Africa. By harnessing the power of community and cutting-edge FinTech, we provide an innovative alternative to the status quo.

Our members are innovative entrepreneurs just like you - ambitious visionaries tired of being held back by a lack of access to capital and customers. Through SFA, these pioneers have found a better way.

By pooling savings and resources on our secure online platform, members can borrow funds at affordable rates to grow their ventures. But that's not all - SFA also creates a vibrant marketplace that incentivizes members to buy and sell with each other.

This unique internal credit system allows businesses to pay each other through SFA "currency" instead of cash. This encourages more commerce within the network, automatically increasing revenue for all involved.

Best of all, our members aren't just customers - they're partners. By supporting each other's dreams, the SFA community experiences shared success. Our technology also makes it easy for members to collaborate, learn from each other, and take advantage of group purchasing power.

SFA is turning the tide of who truly owns opportunity. Join our movement of like-minded entrepreneurs and take control of your future through the power of community commerce. Become a founding member of SFA SACCO today!

No complicated legal forms required

We founded SSCF with a BOLD new vision - to

tear down barriers and replace outdated banking with a model that was ACTUALLY designed for REAL people.

Through our innovative platform, you'll be empowered to SAVE, BORROW, and do BUSINESS in a seamless way... all while connecting with a ready-made community of customers!

No more red tape, no more clunky rules - just the resources and relationships you need to THRIVE.

And that's not all - as members we ALL prosper together. Our guiding principle of "Let's Thrive Together" means the successes of one fuel opportunities for all.

Why We Chose the SACCO Path

We're on a mission to empower local businesses and transform how commerce is done across Africa. To truly achieve our bold goals, we knew we needed a model that could mobilize community resources while providing full legitimacy.

That's why we made the strategic decision to pursue a SACCO license. Becoming a licensed cooperative society allows us to tap into a culture of unity and self-reliance while giving our members proven benefits like:

Overall, becoming a licensed SACCO was the best pathway to legitimately implement our innovative financing solution while also tapping into cultural norms around community- based organizations. It helps lay the groundwork for long-term sustainable impact.

It's Time to Make Them Jealous With Your New Flame, SFA

If you don’t believe your current financial institution values your business anymore, why stay loyal to them? If you’re sick of ever-increasing fees, complicated loan processes, reduced customer service, and big profit banks that are more concerned about their shareholders than you, maybe it’s time you considered making the change to an institution that exists to benefit members.

When you become a member by purchasing your minimum 10 shares, you join our collective of owners. SFA is a member-owned organization, which means the profits belong to you, our valued members.

As fellow cooperatives, we don't have shareholders seeking large profits. So more of your deposits go towards growth, not exorbitant salaries. Speaking of fees, we've waived most common charges that seem designed to nickel and dime customers.

Here at SACCO, we believe advanced technology should improve lives, not just drive profits. That's why we created our industry-leading proprietary tech stack from the ground up. Pre-qualified members can receive funds in as little as 24 hours.

We’re NOT just another bank - We’re a BETTER WAY to do things in the digital age!

SFA isn’t technically a bank —but you’d never know it. Through strategic partnerships with regulated banks, we’re able to tap into the entire financial system. But unlike those other jokers, our SOLE FOCUS is BUILDING PRODUCTS YOU ACTUALLY WANT TO USE! Already we’re empowering OVER 10K members with innovative solutions tailored for real people like you.

It's Not Your Average Banking

Just like you, we're choosy about who we partner with. That's why our backend is rock-solid.

We exclusively align with best-in-class Tanzanian banks regulated to the highest standards. Think serious financial muscles and a proven track record of success.

Not only that, but we vet that they truly believe in our bold mission. We don't settle for half-hearted "me too" partners - we need institutions with the dedication to help us transform banking.

That's why NMB Bank is perfectly poised to handle your deposits with care. And ABSA backs our credit solutions with the strength of a true industry trailblazer.

Together, we're taking the reins to build a whole new breed of financial institution. One that's nimble yet rooted in serious legitimacy.

We Need You to Help Us Build Something Epic!

So far, the feedback on what we’ve created has been absolutely incredible. But we’re just getting started on our mission to transform banking through innovation.

In the months ahead, you can expect a constant stream of cutting-edge new features - from more ways to pay than ever before to special projects that will truly disrupt the status quo.

And here’s where YOU come in - we want to hear your dreams, goals, struggles, and ideas. After all, we built this movement to empower real people like you!

Join our community today to gain early access to brainstorming sessions and beta tests. Your insights will directly shape the future of our products and tools.

Together, through open collaboration, I know we can build an institution that cultivates true prosperity for all.

Rich with features that don’t cost you a dime

While other banks nickel and dime you, we believe powerful tools should be accessible to all. That's why every feature we offer is completely free for members.

From spending insights to savings goals, our suite of financial wellness widgets are designed to help you take control of your finances without costing you a cent.

Get access to low-interest capital fund for personal and personal growth within 3 days.

Get Started In Just 3 Easy Steps

Start by signing up on our intuitive app. Within minutes, you'll receive a verification email. But your enrollment isn't complete until you power up with KYC. That's when things get really interesting. By submitting some basic ID docs, you unlock a whole new world of powerful products previously out of reach. Think access to high-yield savings, low-interest loans, and exclusive investment perks reserved for our most committed members.

Start by purchasing at least 10 shares for only TZS 800k within four months. Not only will you own a piece of this growing movement, but you'll also gain elite access to powerful tools. Next, designate your monthly savings commitment - even a modest TZS 50k can go a long way when paired with the magic of compound returns.

After achieving early savings milestones with SFA, a world of possibilities emerges. First up - access low-interest business loans up to 5x your shares and savings value. Take your entrepreneurial dreams to the next level with the funds to expand operations. That's just the beginning. Your growing equity also grants entry to our exclusive investment club. Profit from the rising fortunes of other members through our venture fund.

What REAL Members Are Saying

I was just going through some of the testimonials we've received from members who have really put SFA SACCO to the test. And let me tell you - these aren't your average glowing reviews. No, these members really put us through the ringer. And in the end, they were absolutely blown away by the results. Just listen to what James had to say:

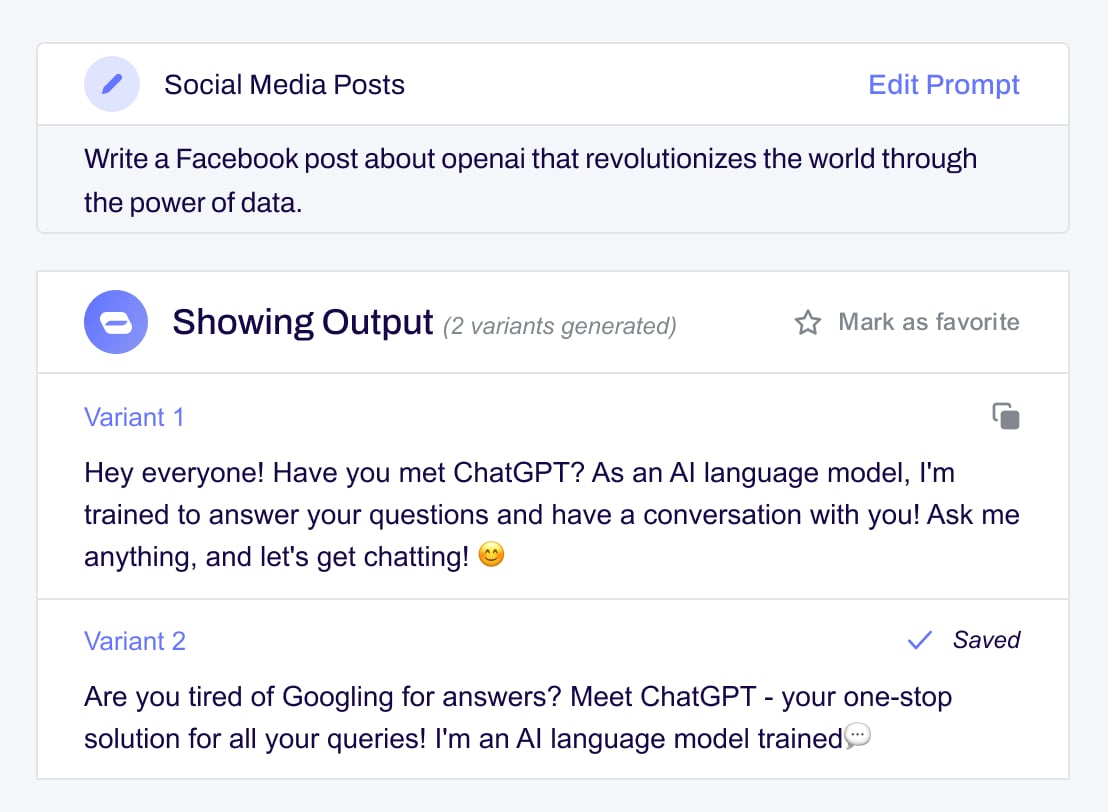

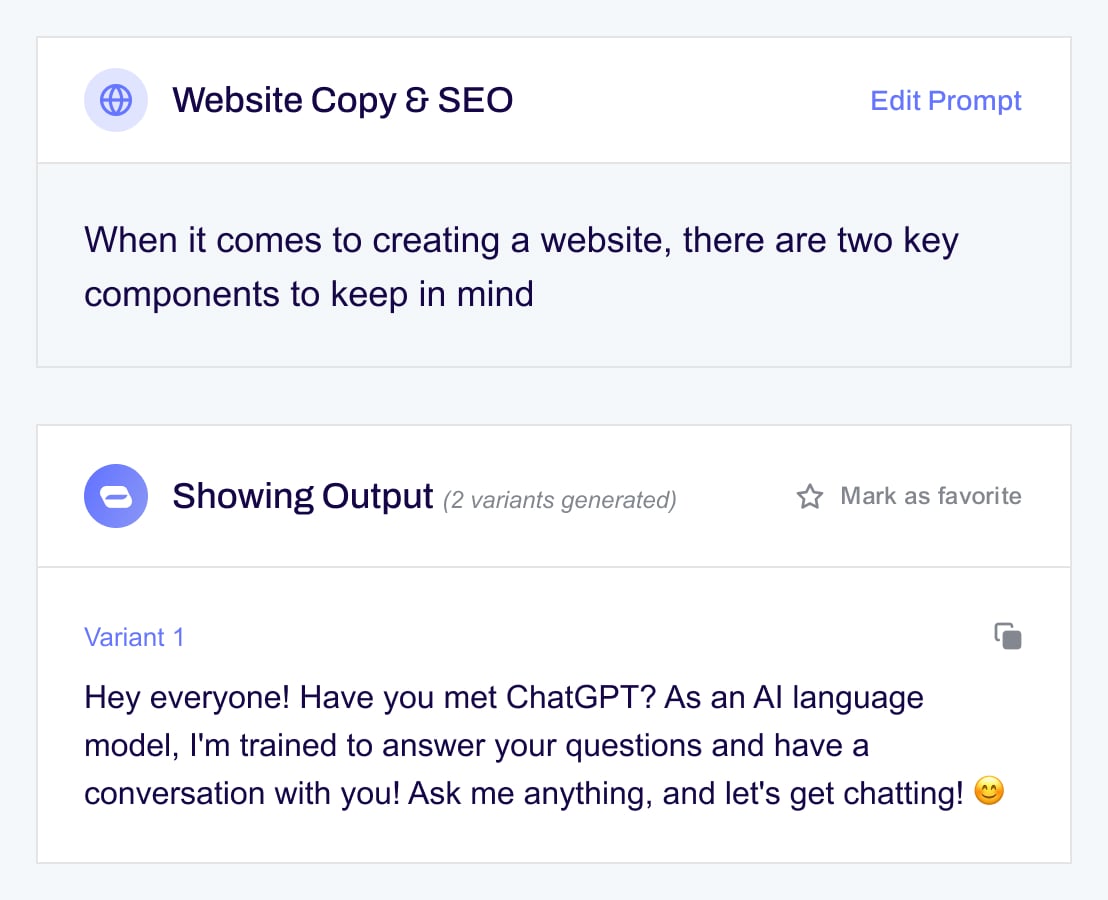

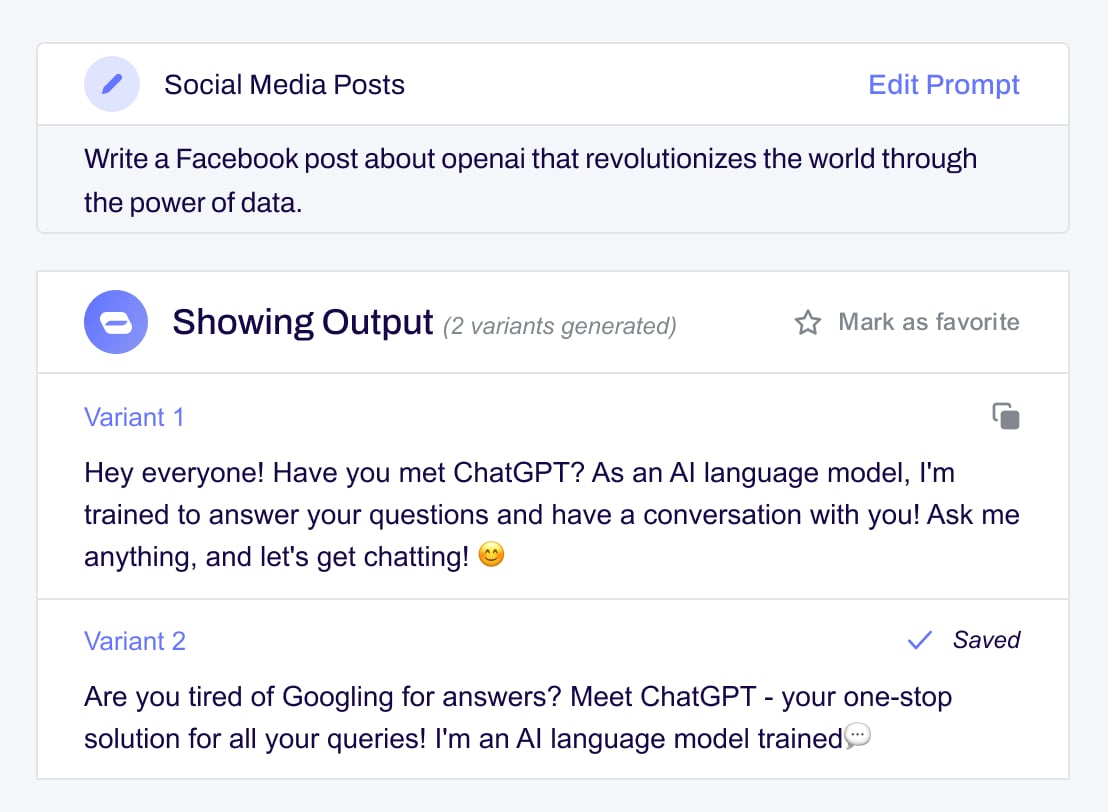

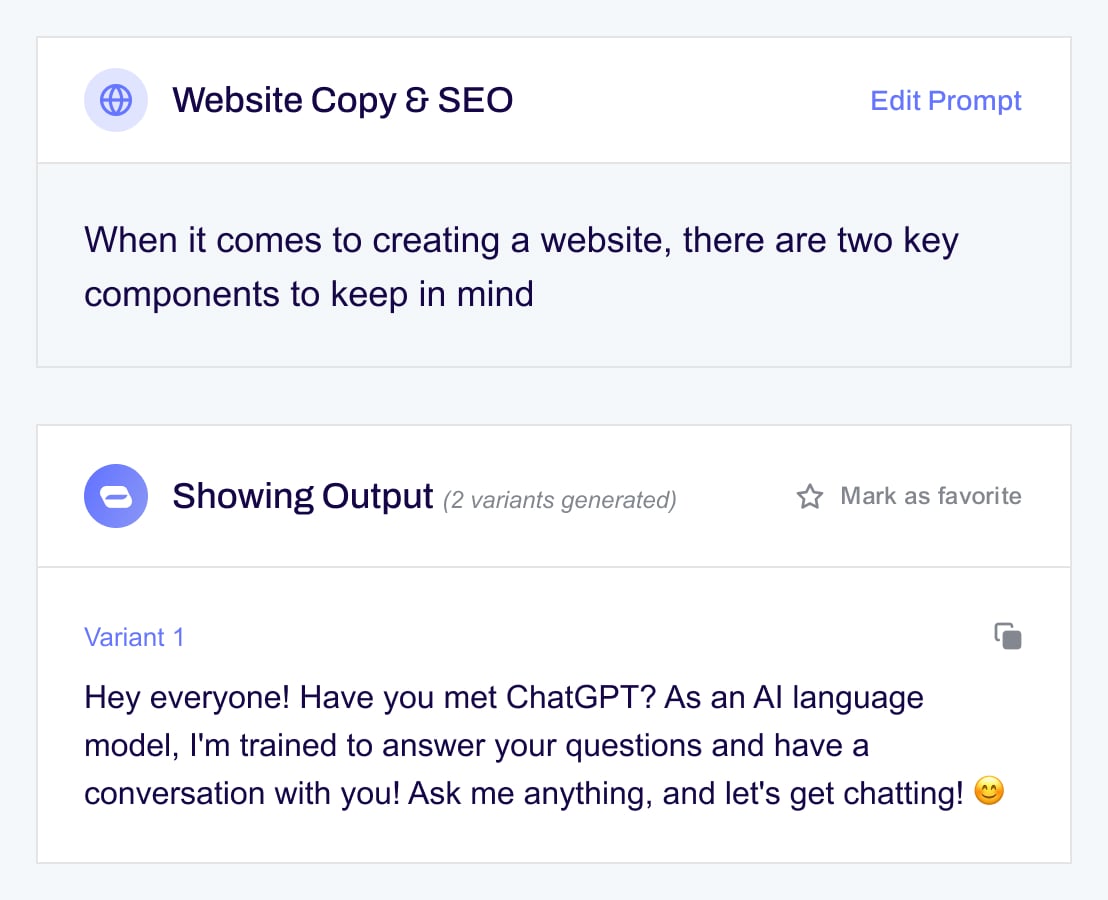

Plans that start free and

fits with your needs

With our simple plans, supercharge your content writing to helps your

business. Let’s make great content together.

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

Basic features for up to 40 users.

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

Basic features for up to 40 users.

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

Basic features for up to 40 users.

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

Basic features for up to 40 users.

- Complete documentation

- Working materials in Figma

- 100GB cloud storage

- 500 team members

Puts Total Control of Your Finances In Your Pocket.

With the SFA App, you can access everything in one place. Our app is your way of accessing all your finances in a single tap. It’s the secure hub where you can make decisions and feel confident in your money management skills. Consider the SFA App your finance advisor in your pocket!

In case you missed anything

Are you confused about anything? Do you have questions about how SFA works or what we offer? You're not alone. That's why we created this FAQ section - to address concerns upfront and help you make an informed decision.

Below you'll find answers to some of our most common queries. And if your question isn't listed, don't hesitate to call or email me. I'd be happy to explain further!

SFA is a Savings and Credit Co-operative (SACCO) whose main objective is to mobilize savings from members and in return provide capital funding facilities.

- Member-owned, empowering members to contribute to the organization’s capital — and to reap the benefits.

- Member-governed, awarding each member with one vote to elect our governing Board of Directors, who set policy and direction for the organization.

- Autonomous and independent, practicing our core values of integrity, people, service, innovation, education, and celebration.

- Education-driven, providing financial education and training to help members and non-members succeed and to contribute positively to the local economy.

- Community-focused, encouraging our employees and members to give back as volunteers, donors, and caring citizens.

- Cooperative-minded, supporting laws and financial services that benefit not-for-profit cooperatives and our members.

It depends on what you are looking for in a financial institution, the level of attention that you want to receive as a customer and the rapidness that you need access to your funds when deposits are made into your bank account.

But if you want more personalized customer service and more attention to detail then a SFA is the place to go. Also, SFA account is not closed unless you as a member makes the decision or breach organization’s policy or constitution. On the other hand, banks do make the decision to close a customer’s account on their own.

What you need to focus on, in our opinion, is ownership.

At a SFA, your money is owned by you. As a not-for-profit entity run by a Board of volunteers, all income is returned to the members or invested back into the building in the form of infrastructure or other investments.

This, generally, allows SFA to offer lower interest rates, higher returns on deposits, and demand a lower (read: cheaper) fee schedule because nothing is being siphoned off the top to pay executives and ownership.

OUR TAKE!

We would naturally say that a SFA is better. It’s a member-owned financial cooperative. The board of directors are members just like you. And generally you get better interest rates and lower loan rates. Any profit the SFA makes is channeled right back into the SFA for the benefit of the members.

Put simply, Banks are for profit institutions owned by people who invested in it and who want a good return on their investment, while SFA is owned by members (YOU) and only need to make enough profit to operate and pay their staff, and any extra goes back to the depositors as interest.

SFA offer better interest on savings, have more “personable services” and have lower interest rates.

SFA offer the same type of services you would find at a bank. But at a bank, you are a customer.

At SFA, you are a member and equal owner with every other member. You have an equal vote.

Here are some TAKEAWAYS:

SSCF:

- Is not-for-profit institution.

- As members, each person that deposits money has a share of ownership

- SFA only serves its members as per its constitution.

- Members elect a volunteer Board of Directors to represent our interests

- Is a member service-driven

- Return profits to members in the form of lower loan rates, higher savings rates, and free or low cost services.

- Federally insured by the TCDC

- Exempt from federal income taxes.

BANKS:

- Are profit-oriented institutions

- Can serve anyone in the general public

- Have customers with no ownership to their organization (unless they also own shares separately)

- Have a paid Board of Directors who represent the Shareholders (owners); customers do not have voting privileges’

- Controlled by shareholders and paid officials

- Return profits to Shareholders

- Federally insured by the Central Bank (BoT)

The annual percentage yield (APY) is the real rate of return earned on an investment, taking into account the effect of compounding interes. Unlike simple interest, compounding interest is calculated periodically and the amount is immediately added to the balance. With each period going forward, the account balance gets a little bigger, so the interest paid on the balance gets bigger as well.

KEY TAKEAWAYS

- APY is the actual rate of return that will be earned in one year if the interest is compounded.

- Compound interest is added periodically to the total invested, increasing the balance. That means each interest payment will be larger, based on the higher balance.

- The more often interest is compounded, the higher the rate will be.

Formula and Calculation of APY

APY standardizes the rate of return. It does this by stating the real percentage of growth that will be earned in compound interest assuming that the money is deposited for one year. The formula for calculating APY is:

Where:

- r = period rate

- n = number of compounding periods

What Annual APY Can Tell You

Any investment is ultimately judged by its rate of return, whether it’s a certificate of deposit (CD), a share of stock, or a government bond. The rate of return is simply the percentage of growth in an investment over a specific period of time, usually one year. But rates of return can be difficult to compare across different investments if they have different compounding periods. One may compound daily, while another compounds quarterly or biannually.

Comparing rates of return by simply stating the percentage value of each over one year gives an inaccurate result, as it ignores the effects of compounding interest. It is critical to know how often that compounding occurs, since the more often a deposit compounds, the faster the investment grows. This is due to the fact that every time it compounds the interest earned over that period is added to the principal balance and future interest payments are calculated on that larger principal amount.

Comparing the APY on Two Investments

Suppose you are considering whether to invest in a one-year zero-coupon bond that pays 6% upon maturity or a high-yield money market account that pays 0.5% per month with monthly compounding.

At first glance, the yields appear equal because 12 months multiplied by 0.5% equals 6%. However, when the effects of compounding are included by calculating the APY, the money market investment actually yields (1 + .005)^12 – 1 = 0.06168 = 6.17%.

Comparing two investments by their simple interest rates doesn’t work as it ignores the effects of compounding interest and how often that compounding occurs.

APY vs. APR

APY is similar to the annual percentage rate (APR) used for loans. The APR reflects the effective percentage that the borrower will pay over a year in interest and fees for the loan. APY and APR are both standardized measures of interest rates expressed as an annualized percentage rate.

However, APY takes into account compound interest while APR does not. Furthermore, the equation for APY does not incorporate account fees, only compounding periods. That’s an important consideration for an investor, who must consider any fees that will be subtracted from an investment’s overall return.

APR vs. APY: What’s the Difference?

Example of APY

If you deposited $100 for one year at 5% interest and your deposit was compounded quarterly, at the end of the year you would have $105.09. If you had been paid simple interest, you would have had $105.

The APY would be (1 + .05/4) * 4 – 1 = .05095 = 5.095%.

It pays 5% a year interest compounded quarterly, and that adds up to 5.095%. That’s not too dramatic.

However, if you left that $100 for four years and it was being compounded quarterly then the amount your initial deposit would have grown to $121.99.

Without compounding it would have been $120.

X = D(1 + r/n)n*y

= $100(1 + .05/4)4*4

= $100(1.21989)

= $121.99

where:

- X = Final amount

- D = Initial Deposit

- r = period rate

- n = number of compounding periods per year

- y = number of years

How Is APY Calculated?

APY standardizes the rate of return. It does this by stating the real percentage of growth that will be earned in compound interest assuming that the money is deposited for one year. The formula for calculating APY is: (1+r/n)n – 1, where r = period rate and n = number of compounding periods.

How Can APY Assist an Investor?

Any investment is ultimately judged by its rate of return, whether it’s a certificate of deposit, a share of stock, or a government bond. APY allows an investor to compare different returns for different investments on an apples-to-apples basis, allowing them to make a more informed decision.

What Is the Difference Between APY and APR?

APY calculates that rate earned in one year if the interest is compounded and is a more accurate representation of the actual rate of return. APR includes any fees or additional costs associated with the transaction, but it does not take into account the compounding of interest within a specific year. Rather, it is a simple interest rate.

Nop!

Don’t convince anyone to join SFA, just educate them and let them make their decisions.

Keep sharing information with your friends, and remember 4SW… some will, some wont, so what, someone’s waiting.